Ever tried drinking water from a firehose? No? Well, let me tell you—it’s not refreshing. You don’t quench your thirst; you just get drenched. And that’s exactly how this week felt. President Trump unleashed a deluge of announcements and Executive Orders, leaving many of us completely soaked (read - confused).

Image courtesy: Dall-E

The U.S. stock market, however, seemed to interpret this chaos as a pleasant shower. In a shortened trading week (thanks to the Monday holiday), the market rallied, erasing a month’s worth of losses.

Trump’s Word Salad

President Trump was, shall we say, strategically vague on the scary stuff, like those ominous 25% tariffs on Canada and Mexico that he’s merely “thinking” about. On the flip side, he was crystal clear about things corporations love—like yanking the U.S. out of the OECD global tax treaty. The Tech Bros and Big Crypto probably sent him thank-you cards for that one.

Speaking of crypto, Trump signed an Executive Order to explore a “crypto strategic reserve.” Link Bitcoin enthusiasts went bananas, predicting an $800,000 price target. I mean, who needs restraint when you’ve got hype? Crypto inflows hit their second-highest level ever last week, because why not? Link

But not all of Trump’s moves are cruising smoothly. His attempt to end birthright citizenship? Blocked by the Supreme Court as unconstitutional. The man may sign fast, but implementation? That’s a different story.

AI: The Other Star of the Week

Outside the Trump tornado, AI had its own spotlight moment. News of a new mega-joint venture—funded by OpenAI, SoftBank, Oracle, and provided with technology from a whole alphabet soup of tech giants—set the tone. The JV, named “Stargate,” might pump up to $500 billion into U.S. AI infrastructure. We’re talking about a firehose of funding here.

Bonds, Gold, and a Calm(er) Dollar

The bond market finally chilled out, taking the dollar with it. That calm rippled across global markets, pushing most assets higher. Even gold decided to party, flirting with all-time highs. It’s like everyone collectively agreed: “Uncertainty? What uncertainty?”

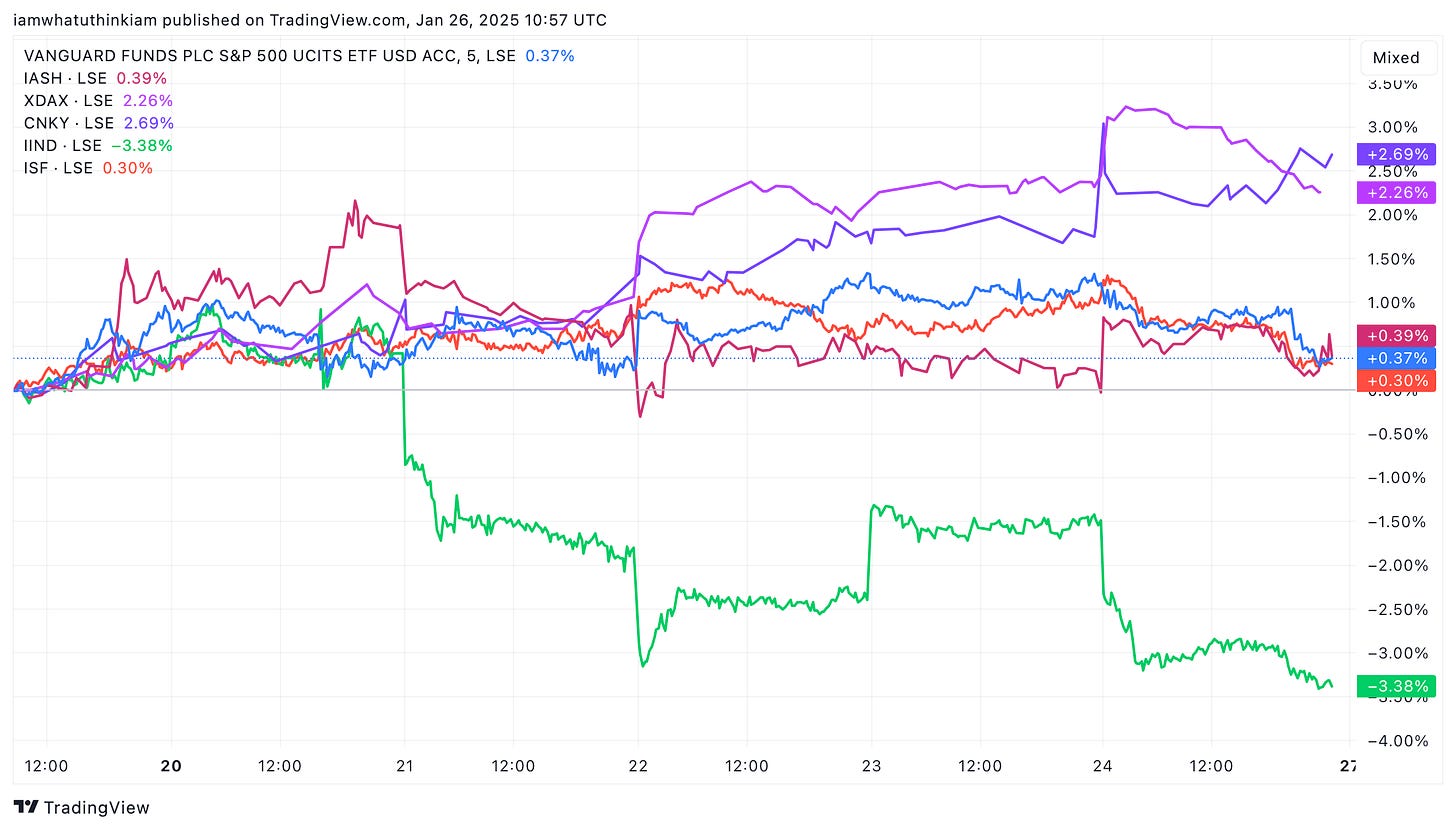

Japan, Germany, and a World of Green

Over in Japan, a rate hike didn’t hit the yen much and bolstered rising confidence in domestic consumption. The Japanese stock market had its best week in a little while —practically a time machine back to the mood music of early 2024.

Germany wasn’t far behind, with its stock market celebrating the best month in two years. If someone had invested here even a few weeks back, they would be sitting on a pretty packet. Energy-sensitive Germany has every reason to toast Trump’s “drill, baby, drill” mantra, which promises lower global energy costs. Even geopolitical tensions took a backseat as Trump and Putin made vague overtures about ending the Ukraine conflict. Hope springs eternal.

India’s Grim Reality

Meanwhile, India had a rough week. Three weeks of market declines have erased nearly all gains since Modi’s last election win. Earnings reports were grim (Link)—Dr. Reddy’s, SBI Life, and BPCL all flopped. Wipro showed some fight, and HDFC Bank was resilient, but let’s face it, they were silver linings in a cloudy sky. One more week and the market will begin rivalling the last deep draw-down of October.

Investors are anxiously eyeing the upcoming Budget on February 1 and the RBI’s rate-setting meeting soon after, for a reprieve. Reliance Industries, India’s largest corporate, ever the overachiever, announced a $30 billion plan to build the world’s largest data center in just two years. Talk about going big or going home.

China and the UK: Middle of the Pack

China’s stock market barely moved this week, possibly waiting for the next big thing from Trump. Beijing is quietly nudging its financial institutions to buy more shares, which could inject up to $60 billion into the markets over the next three years. Subtle, but effective. Link

The UK, on the other hand, had a stinker of a week. Government borrowing is through the roof, and job cuts are happening almost as fast as during the 2009 recession. To top it off, a weaker dollar hurt the FTSE 100, most of whose members earn in foreign currencies. No wonder the market didnt go anywhere.

Looking Ahead: More Firehose Moments

Next week promises no relief. Trump and his opponents will undoubtedly keep us all on edge. Central banks, including the Fed and ECB, have rate-setting meetings, and India’s Finance Minister will unveil the Budget on Saturday. Many members of the Mag 7 announce results next week. Thankfully, the Chinese New Year might mean a quieter week from Asia. Fingers crossed.

Final Thoughts

If this week taught us anything, it’s that markets overreact—to good news, bad news, and everything in between. So, don’t let the firehose drown you. Stay balanced, play the long game, and remember: investing is a marathon, not a sprint.