Spring Break typically signals a mass exodus of American college students to sunny beaches and questionable decisions. But this past week, it felt like US markets joined them.

After four straight weeks of sliding downhill like a greased bowling ball, US stocks finally bounced. And boy, did they need it. The market’s been slogging through a swamp of bad news, leaving traders wondering if someone accidentally switched CNBC with a horror channel.

One big sign of the doom-and-gloom: the Bank of America Fund Manager Survey revealed the largest drop in US equity allocations. Ever. Usually, that’s when the Federal Reserve swoops in like a market-soothing Superman. Not this time. Fed Chair Powell did his usual dance, hinting that rate hikes aren’t likely (cue the classic "inflation is transitory" line), but Wall Street’s optimism barely lasted 24 hours. Even a dead cat bounces when it hits the floor – and this could very well be that cat.

Now, everyone’s staring at April 2nd—Liberation Day, apparently—when President Trump decides if Canada and Mexico get slapped with those 25% tariffs. Will it be a market shocker or a political shrug? Depends on whether he wakes up on the right side of the bed—or tweets from it.

Meanwhile, the markets have been doing their own random number generator impression. Sure, gold is climbing, but who would have guessed that copper would be stealing the show — its up 25% year-to-date thanks to speculation that tariffs could target it next. Who knew copper could party this hard?

Corporate earnings aren’t exactly helping the mood either. Nike, Delta, FedEx—they’re all waving the “we’ve got tariff problems” flag. Oh, and DOGE? It’s not just a meme anymore; it’s a punchline in boardrooms such as those of Accenture. And if you thought AI was immune, think again. The AI bubble is slowly deflating like a sad balloon at a kid’s birthday party. Just look at the top tech players: Microsoft, Alphabet, Broadcom, TSMC, ASML, Amazon, Meta, Nvidia. Only Microsoft eked out a tiny 0.62% gain last week—probably from sheer willpower. Most were down - at one stage as much as by 6%.

On the geopolitical stage, Trump’s Russian negotiations resembled a bad cha-cha: one step forward, two steps back. Putin kept him waiting for an hour for his Tuesday call, then offered a measly 30-day pause on Ukraine’s energy infrastructure. Link Spoiler: those promises didn’t even last the week.

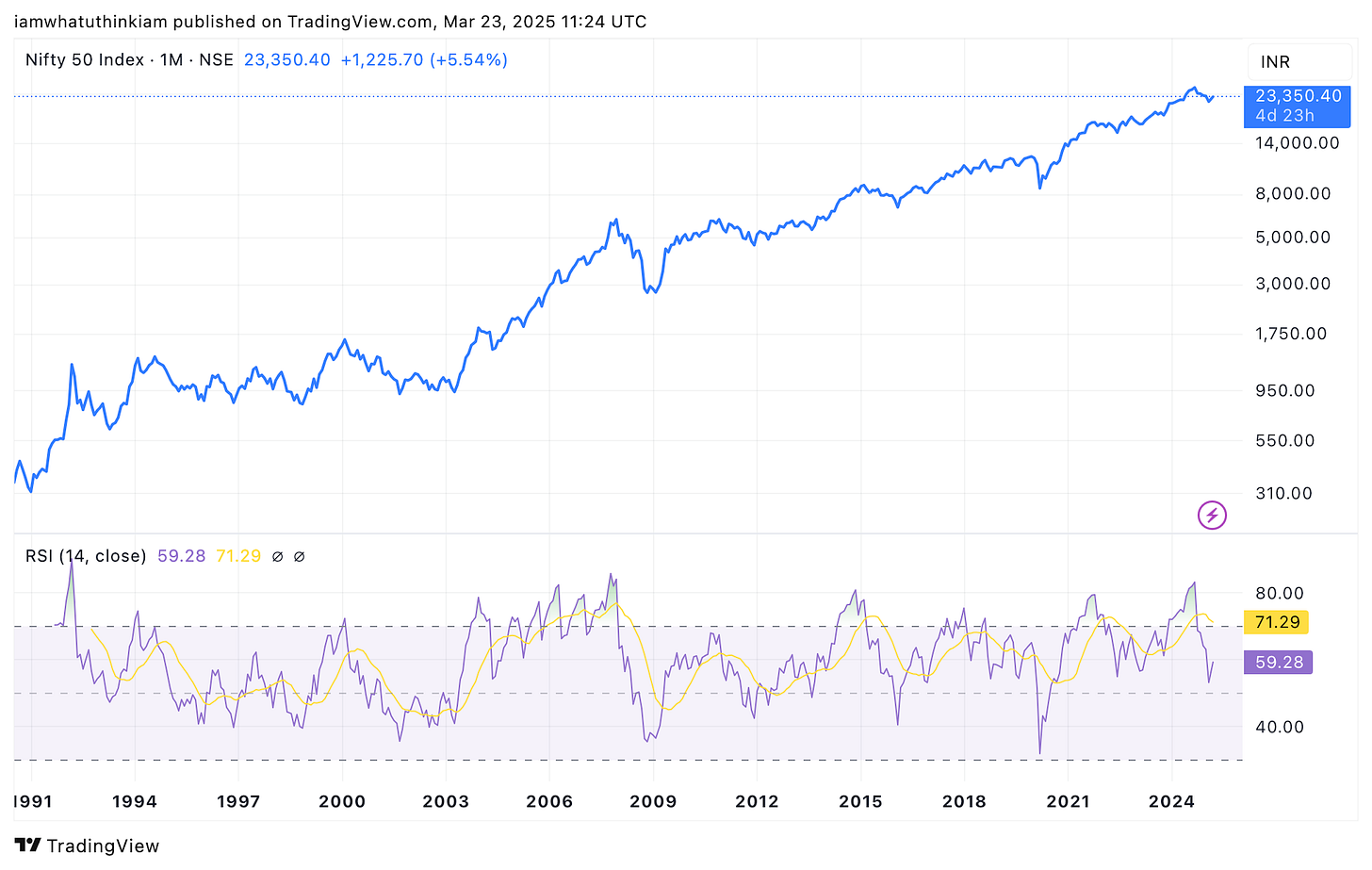

No surprise then that investors are increasingly looking beyond US shores. Remember my musings about India back on March 2?

Well, karma kicked in. Indian stocks just had their best week in four years, and the rupee strengthened too. For UK-based investors, that’s been good for a tidy 7-8% return, whether you’re riding ETFs or more actively managed vehicles.

China? Different story. The government rolled out yet another plan to juice domestic demand—cue the fireworks early in the week as investors got excited. But by Friday, the enthusiasm fizzled faster than flat soda. BYD, China’s EV darling, announced lightning-fast 5-minute charging stations to build on its other key recent announcement of budget models with FSD tech. It surged 8% midweek, only to limp into the weekend with just a 1% gain. Profit-taking after a rapid recent rise in both cases?

Over in Europe, Germany passed its much-anticipated €1 tn defense and infrastructure package, and in typical market fashion, stocks—led by Rheinmetall, Germany’s defense darling—sold off. Classic “buy the rumor, sell the news.”/ profit-taking

The UK market? More like “meh.” The Bank of England refused to cut rates, wary of inflation risks from tariff wars. Chancellor Reeves now faces a tricky balancing act with her Spring Statement next week. With talk of fiscal black holes and self-imposed rules, investors are bracing for more spending cuts on top of last week’s welfare trim. Such a poor backdrop may offset the inflationary effects that the Bank of England is worried about but only time will tell.

Japan kept it quiet—no surprise rate tweaks from the Bank of Japan this time.

So, what’s the takeaway? Last week feels like a temporary reprieve for US investors. The US market is staring down two forces: Trump’s trade antics and a cooling AI craze. It’s a tricky spot—some might flock to dividend payers, value stocks - banks anyone? Or even unloved names like Tesla, which may be quietly turning a corner. But with Trump holding the mic (and his team, possibly the wrecking ball) until the next election cycle heats up in 12-14 months, US assets - whether equities or bonds - might stay shaky.

So, where’s the next party?

Non-US markets could be safer havens. But beware: Germany might have looked attractive in early December - some readers may remember my post on 8 December.

But both Europe and the UK may be running on fumes. Both may look cheap on valuations but are flashing overbought signals based on Relative Strength Index (RSI) levels—historically, that’s when the music stops, and chairs disappear.

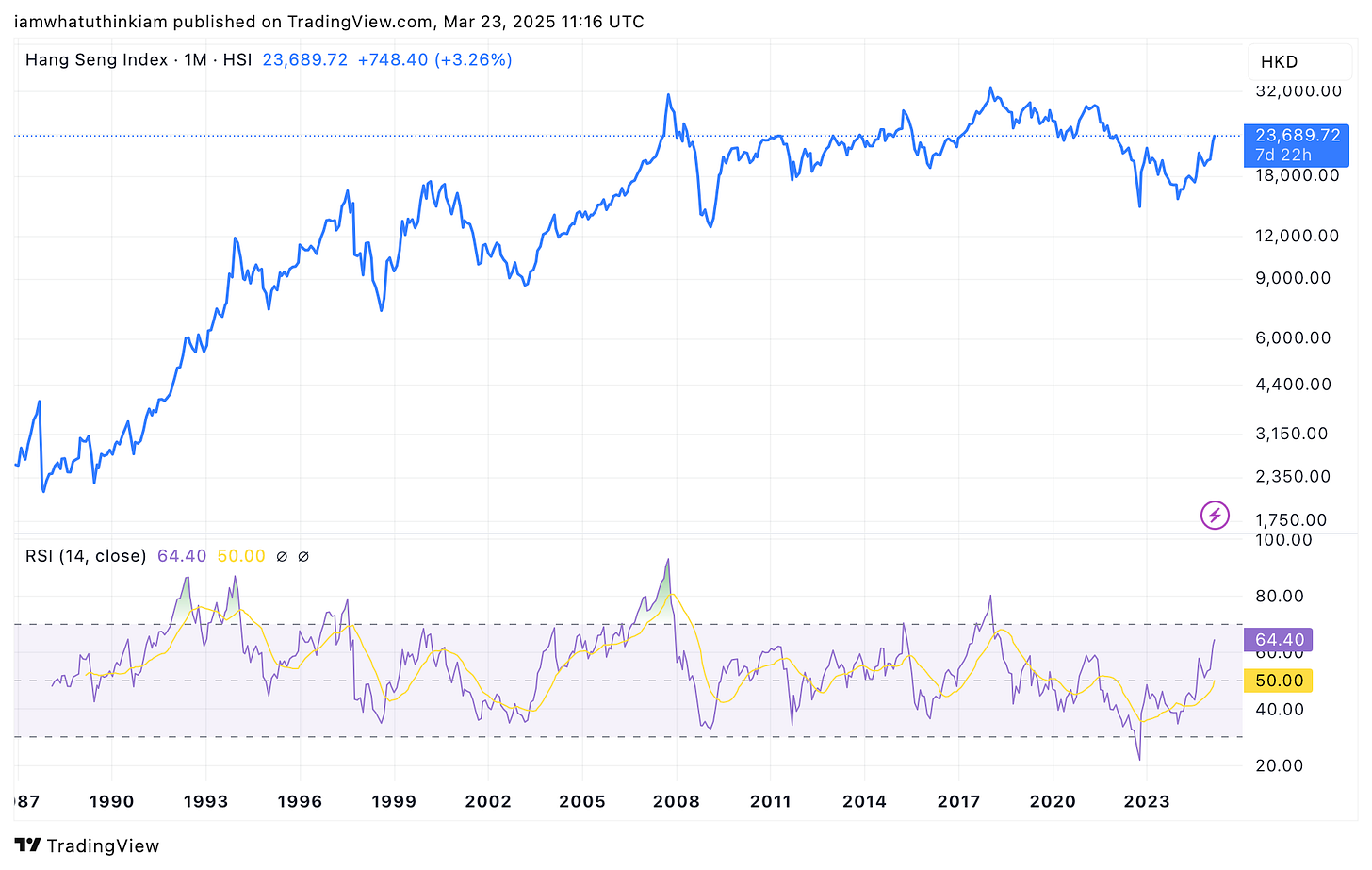

China’s rally looks tired - its RSI may not be in over-bought territory but has surpassed the euphoria of all but the 2018 era by now. Who knows what 2 April brings for the market?

Japan’s AI-heavy market could stay volatile. Its been flatlining since March last year.

India might be a decent contender, with rate cuts likely in April and June, providing a tailwind to the battered sentiment. Tax cuts kicking in from April 1st could boost consumer spending. Link

April 2nd looms large. Until then, strap in. Markets might just keep channelling their inner Spring Breakers—sunburnt, disoriented, and somehow still looking for the next party.

Super blog Gautam! Aren't we all looking forward to April 2nd!